Trouvez vos futurs bureaux

à Paris et en Île-de-France

Nos services

Knight Frank est un conseil international en immobilier. Spécialiste en immobilier tertiaire et résidentiel, Knight Frank bénéficie d’un positionnement unique dans le monde du conseil immobilier.

Bureaux

Knight Frank conseille et accompagne les entreprises dans la commercialisation de leurs actifs.

En savoir plus Bureaux

Investissement

Conseil et accompagnement en investissement en immobilier commercial en France.

En savoir plus Investissement

Commerces

Location et vente de boutiques à Paris et en France pour le compte de clients français et internationaux.

En savoir plus Commerces

Concevoir et aménager vos bureaux

Knight Frank Design & Delivery accompagne les entreprises dans leur aménagement d'espaces.

En savoir plus Travaux et Aménagements

Expertise

Knight Frank Valuation & Advisory une gamme complète de services d'expertise immobilière.

En savoir plus ExpertiseNos offres immobilières

Coworking

Consulter nos offres

Bureaux

Consulter nos offresNos références

Ils nous ont fait confiance

Notre actualité, nos engagements

Nos publications

Knight Frank conseille et accompagne les entreprises dans la commercialisation de leurs actifs.

En savoir plus

Nos partenaires

Knight Frank étend son réseau mondial et éuropéen avec deux nouveaux partenaires.

En savoir plusNotre présence

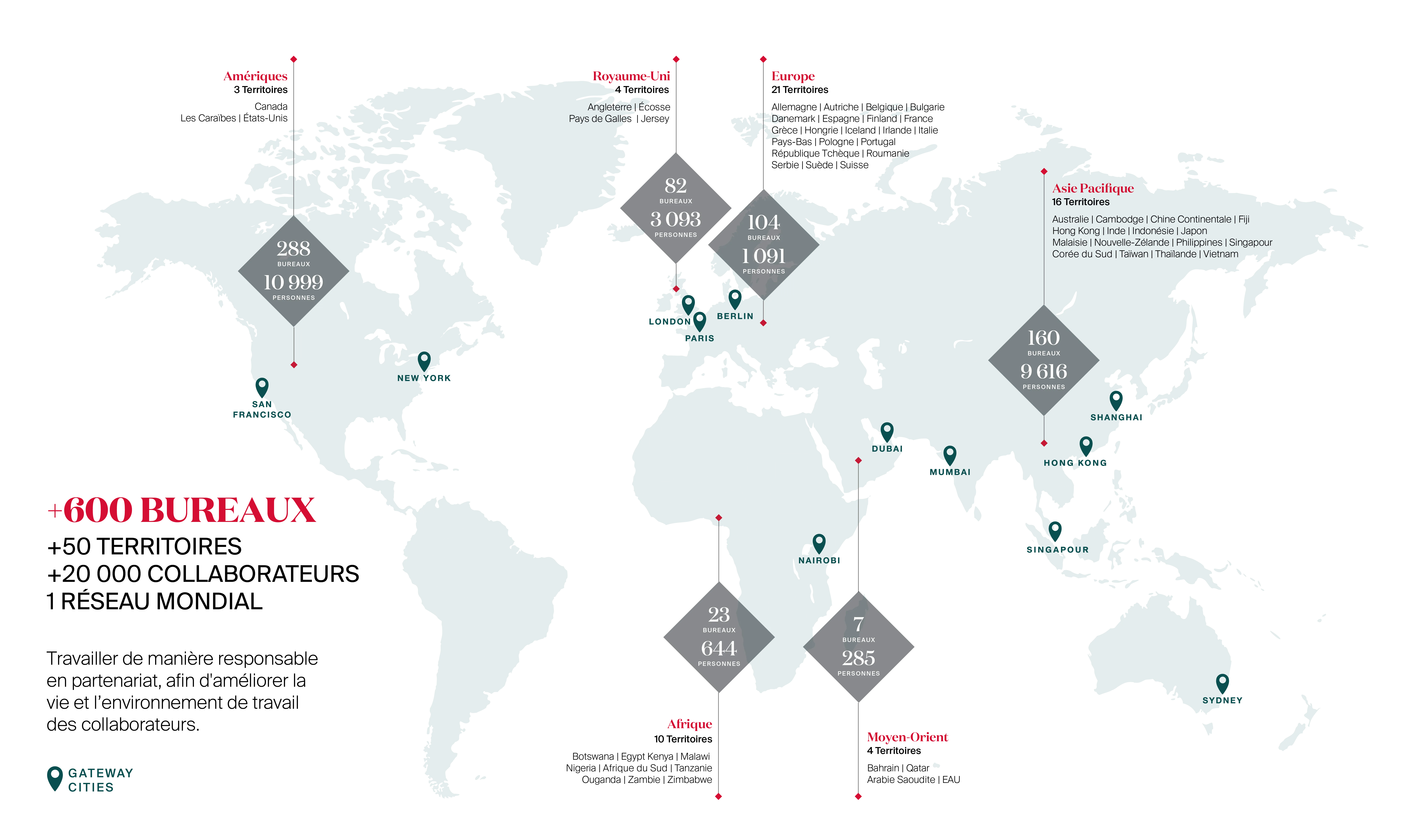

Fondé il y a 125 ans en Grande-Bretagne, le groupe Knight Frank

apporte aujourd’hui son expertise comme conseil international en immobilier.

0

territoires

0

collaborateurs

0

bureaux

Amériques 3 territoires

Royaume-Uni 3 territoires

Europe 18 territoires

Moyen-Orient 3 territoires

Asie Pacifique 15 territoires

Afrique 9 territoires